LaunchPAD Togo

Togo - 2 Year(s)10%

Startup Pitch Page

OVERVIEW

LaunchPAD Africa is rebuilding investment, making it – accessible, convenient, and affordable for all. With as little as ¢100 anyone can invest in startups and small businesses that matter. We offer investors and wanna be investors an end-to-end solution for diversifying their portfolios, when they need them!

LaunchPAD Africa is a crowdfunding, investment and savings portal connecting startups seeking capital with investors for equity and debt financing.

To help expand our operations across Africa.

THE PROBLEM

- Low Consumer Purchasing Power

- Complex and Inconsistent Regulations

- Inadequate Data Communications

- Infrastructure

- Scarce Capital

- Digital Talent

A digital-only investment and savings platform. Enabling direct investments into African Startups; Real Estate, Agriculture, Transportation, and many more whilst allowing individuals to save toward events like, the birth of a child, rent, school fees, birthdays, Christmas, & so much more for a 3-12months duration at different interest rates.

LaunchPAD helps Startups and growing enterprises achieve their financial goals by helping them raise funds and individuals save with ease. Grow your business confidently by raising capital the right way with LaunchPAD, by getting listed on our pre-vetted Startup investment opportunities.

Available on Web, Android and iOS. Soon on USSD (so users can access without the Internet, anywhere they have a cell phone signal).

INVEST THE RIGHT WAY

LaunchPAD is the leading online Startup investment platform in Ghana. We help you invest monies that you would normally be tempted to spend.

LaunchPAD is a unit-based investment platform. With LaunchPAD, individuals and investment firms can invest in projects by buying units, this is what LaunchPAD is for.

It’s Built to be beautiful, fast, and powerful. It supports a fully automated investment and settlement system.

Equity

Investors receive equity in the entity raising the funds or a share in its revenue.

Debt – P2P Loans

Lenders receive interest on loans and are paid the principal upon expiration of the loan or successful completion of the project for which the loan was obtained.

Rewards

Contributors are given non-financial rewards such as priority access to a successfully launched service, product or event.

SavingsAllowing individuals to save toward events like, the birth of a child, rent, school fees, birthdays, Christmas, & so much more for a 3-12months duration at different interest rates

State of the art technology and secure payments gateways integrated for fast trading

PRODUCTS AND SERVICES

Project investment means investing in real estate, agriculture, transportation, startups.

STANDARD INVESTMENTS:

Involves investing a fixed amount for a certain duration with unique features like recurring capital, buying plans with coupons, claiming profit anytime, contact agreement, investment bonuses.

MICRO SAVINGS:

Save towards the birth of a child, birthdays, Christmas, rent, school fees, & so much more for a 3-12month duration at different interest rates.

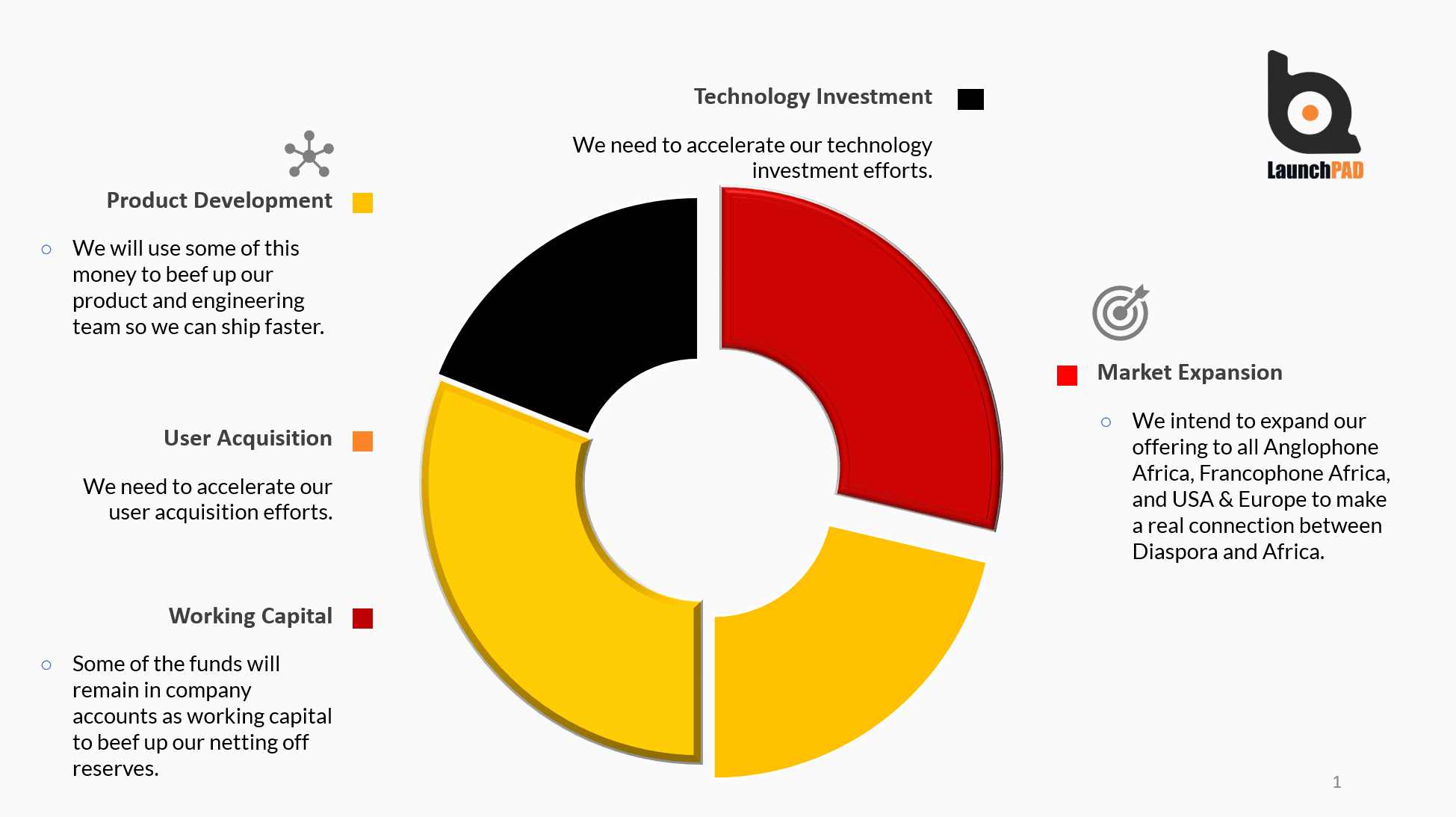

USE OF PROCEEDS:

- The funding will be used to expand LaunchPAD’s product development and engineering capabilities, marketing and sales, and customer support teams as it prepares for its launch.

- LaunchPAD will offer a fully integrated investments and savings solution designed for small to medium sized businesses that currently rely on multiple means of fundraising.

How LaunchPAD Makes Money:

LaunchPAD generates revenue like any other option for Fintech. We intend to charge the lowest commisions on every raise.

Competitive Advantage:

LaunchPAD has three (3) main competitive advantages: proprietary software, efficient decentralized branches across Africa, and a digital-based service model.

All these factors combined provide what we believe is a competitive advantage for LaunchPAD over both traditional AND next-gen competitors which we believe translates into more convenient, accessible, and affordable means of investing across Africa.

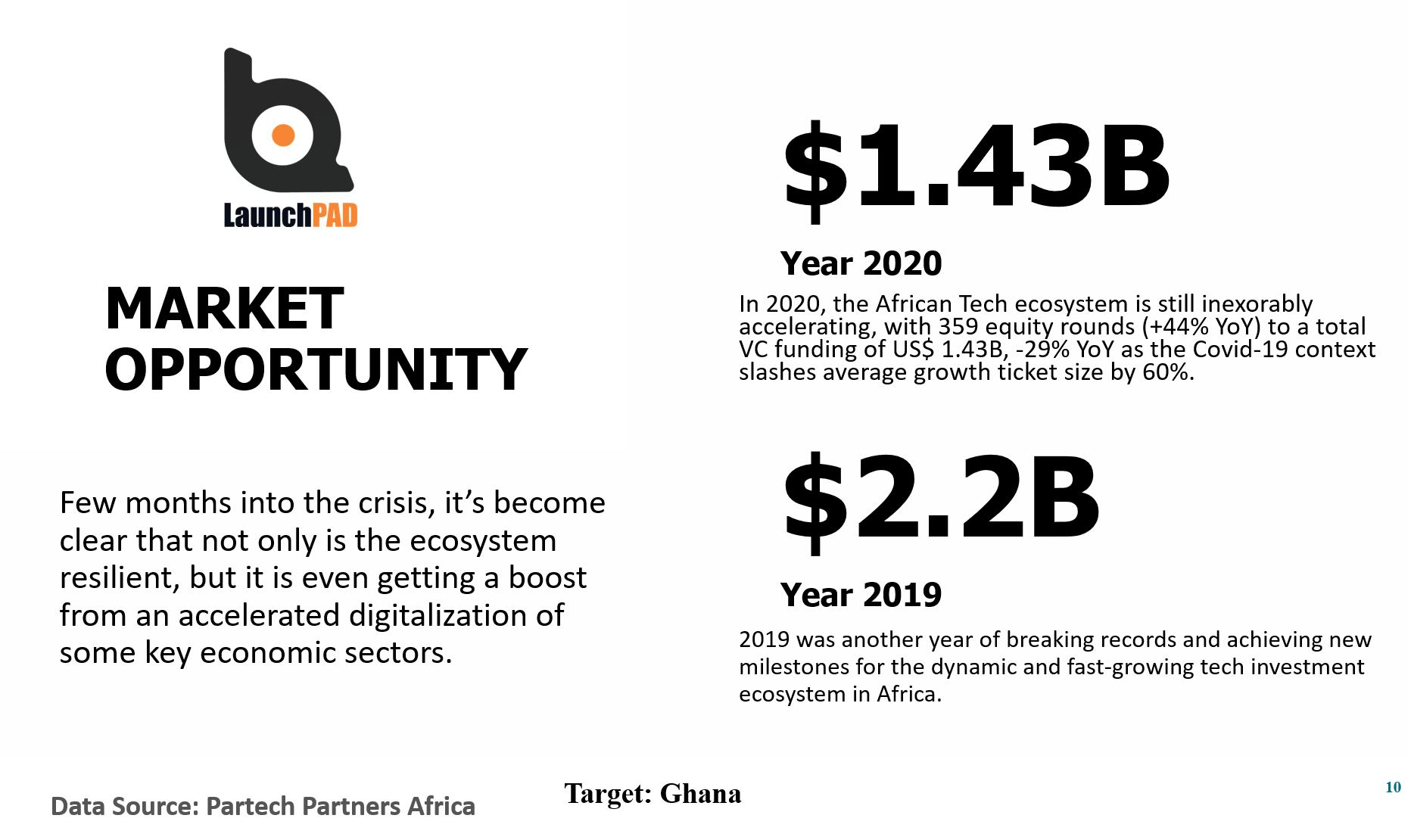

MARKET SIZE

TEAM STORY:

Our inspiration for starting LaunchPAD stems from the hurdles every African satrtup faces when trying to raise capital on the continent, irrespective of the jurisdiction, and our own experiences on numerous attempts to raise within the continent.

African Startups and small businesses looking to raise funds on the contitnent has to turn to the banks or connected rich folks...each with its own headache. These banks requires collaterals a startup business can't afford so has to be listed on foreign platforms and in most cases, register their businesses overseas to be able to raise internationally.

The continent boasts of smart bold ideas from small businesses and startups looking to either birth, grow, sustain and scale their businesses and ideas yet stuggles to get the needed capital. We want to remedy that, not just by making profit for ourselves, but as a service to our dear contitnent, inother to inspire change in critical-thinking and motivate future developments of Africa, something every African youth is fighting for!

LaunchPAD was conceived in 2016 but went online in 2020.

Now, we're expanding continental, targeting whole of West Africa, some selected East, Central, Southern and Northen African countries.

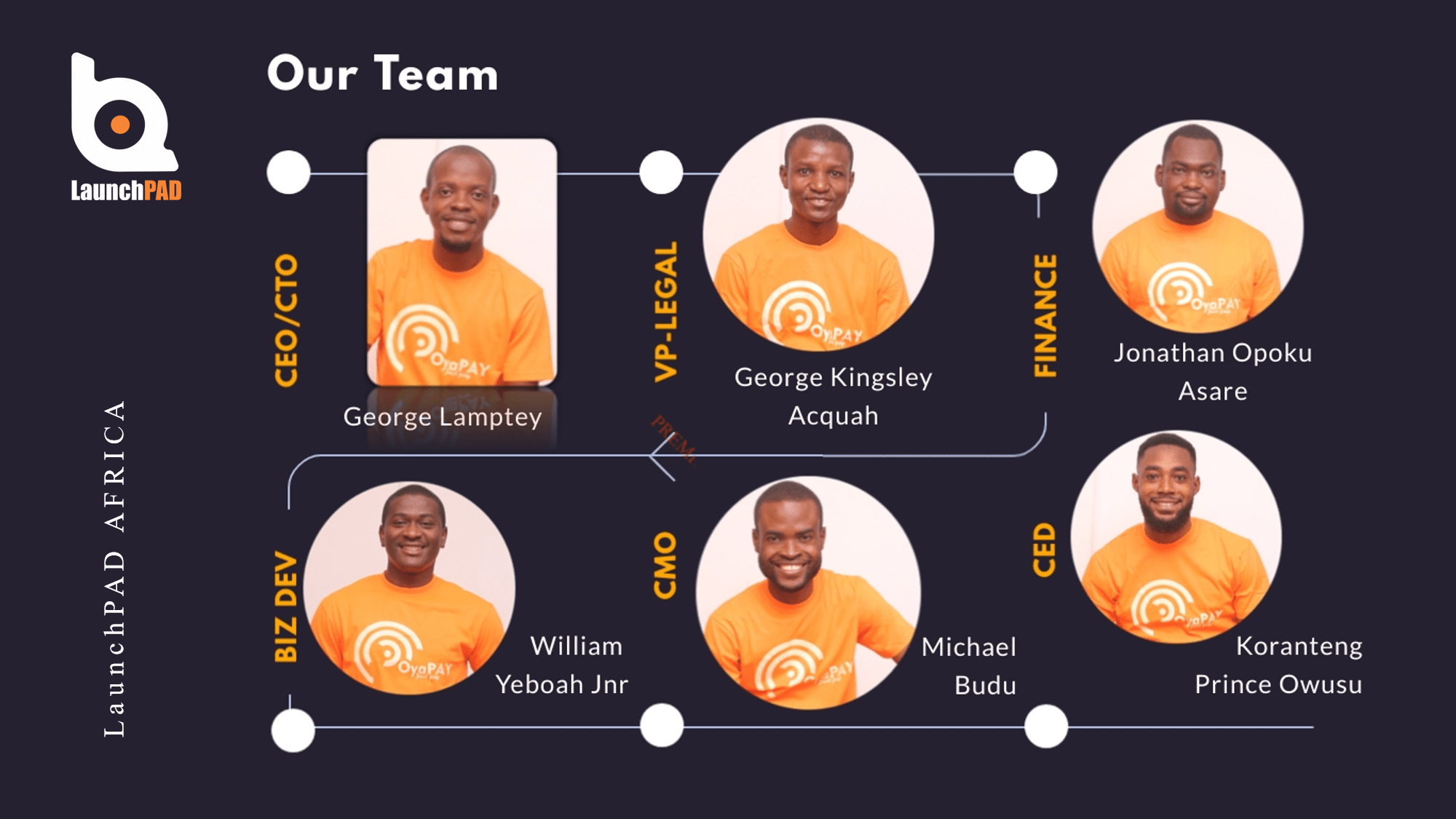

WHO'S BEHIND?

Gasby Group is a Pan-African leading technology organization offering Fintech, E-commerce, Business Intelligence Technology, Health Technology and Real Estate enabled solutions and services across Africa.

Our style is to lead with empathy and come together as a team to have a positive impact on the communities we serve. That’s why our values revolve around putting design first, setting the bar high, and doing what’s best for businesses and the continent.

We deliver HITECH transactional services, systems integration and managed services, ICT outsourcing services, strategic and technical consultancy, and a comprehensive range of enterprise-class managed cloud services coupled with an interest in general business solutions and services.

Join us build Africa's best tech solutions together. Make an impact and grow in your career or business at a startup with an inspiring mission.

OUR MISSION

Our mission is to create Africa's most innovative technology enabled services and products oriented ecosystem; a powerhouse to help drive developmental change across Africa.

OUR PROMISE

- Gasby Group is very much in-tune with the perculiar needs of the Ghana and African Startups and the SMEs sector. As the sector keeps changing, we keep ahead of our clients' needs by being innovative in the services we offer.

- We focus on making it convenient for SMEs and startups to access resourceful technologies as tools for their businesses using web, mobile, social media platforms and many more channels in reaching the most elusive of clients.

- With a plethora of skills and expertise, Gasby Group is the best and right choice to fulfil every SME and startup needs. Well qualified team to match and manage specific job/role requirements.

- Having served and worked with different brands with various needs, we have cultured the ability to discern distinct demands that we fulfil consistently.

We pride ourselves on hiring exceptional talent -- our team members come from a wide variety of top-tier African tech companies, professional services firms, and industry leaders.

To continue our rapid growth, we're looking to bring on people who are passionate about our mission and excited to work in a small startup environment. We have competitive salary and stock options and great benefits.

Term Sheet

General Risks and Disclosures

Start-up investing is risky. Investing in startups is very risky, highly speculative, and should not be made by anyone who cannot afford to lose their entire investment. Unlike an investment in a mature business where there is a track record of revenue and income, the success of a startup or early-stage venture often relies on the development of a new product or service that may or may not find a market. Before investing, you should carefully consider the specific risks and disclosures related to both this offering type and the company which can be found in this company profile and the documents in the data room below.

Your shares are not easily transferable. You should not plan on being able to readily transfer and/or resell your security. Currently there is no market or liquidity for these shares and the company does not have any plans to list these shares on an exchange or other secondary market. At some point the company may choose to do so, but until then you should plan to hold your investment for a significant period of time before a "liquidation event" occurs. A "liquidation event" is when the company either lists their shares on an exchange, is acquired, or goes bankrupt.

The Company may not pay dividends for the foreseeable future. Unless otherwise specified in the offering documents and subject to the country law, you are not entitled to receive any dividends on your interest in the Company. Accordingly, any potential investor who anticipates the need for current dividends or income from an investment should not purchase any of the securities offered on the Site.

Valuation and capitalization. Unlike listed companies that are valued publicly through market-driven stock prices, the valuation of private companies, especially startups, is difficult to assess and you may risk overpaying for your investment. In addition, there may be additional classes of equity with rights that are superior to the class of equity being sold.

You may only receive limited disclosure. While the company must disclose certain information, since the company is at an early-stage they may only be able to provide limited information about its business plan and operations because it does not have fully developed operations or a long history. The company may also only obligated to file information periodically regarding its business, including financial statements. A publicly listed company, in contrast, is required to file annual and quarterly reports and promptly disclose certain events through continuing disclosure that you can use to evaluate the status of your investment.

Investment in personnel. An early-stage investment is also an investment in the entrepreneur or management of the company. Being able to execute on the business plan is often an important factor in whether the business is viable and successful. You should be aware that a portion of your investment may fund the compensation of the company's employees, including its management. You should carefully review any disclosure regarding the company's use of proceeds.

Possibility of fraud. In light of the relative ease with which early-stage companies can raise funds, it may be the case that certain opportunities turn out to be money-losing fraudulent schemes. As with other investments, there is no guarantee that investments will be immune from fraud.

Lack of professional guidance. Many successful companies partially attribute their early success to the guidance of professional early-stage investors (e.g., angel investors and venture capital firms). These investors often negotiate for seats on the company's board of directors and play an important role through their resources, contacts and experience in assisting early-stage companies in executing on their business plans. An early-stage company may not have the benefit of such professional investors.