OyaPay Ghana

Ghana - 2 Year(s)17%

Startup Pitch Page

OVERVIEW:

WELCOME TO THE PAYMENT FUTURE

At OyaPAY, we are turning every smart device; smartphone, tablets and desktop PCs into a simple & efficient yet robust and convenient and an uncompromising secure Payment enabled channels throughout Africa and beyond. A tool for businesses to integrate a payment system into their website, mobile applications and stores to get paid globally. For businesses that sell a product, a service or accept donations.

THE PROBLEM

- Large portion of the continent still pay with cash.

- Lack of digital-payment penetration.

OyaPAY is a digital wallet payments platform. We enable fast and secure cross-border payments, with or without a bank account

OyaPay seamlessly fuses fiat money, cryptocurrency and other digital assests into a one-account fit all approach and comes with a beautiful Storefront for merchants to sell/trade their goods/services easily.

We support payments into Senegal, Togo, Mali, Benin, Guinea, Ghana, Nigeria, Burkina Faso, Liberia, The Gambia, Cape Verde and the Ivory Coast, with more countries launching soon.

Global remittances account for over $500 billion annually, most of which moves back into developing countries. But the market is dominated by traditional services that are expensive, can take days to arrive, and have limited reach in rural areas. We're helping people to send that money instantly and securely at a fraction of the cost. In doing so, we are working on making the UN Sustainable Development Goal of bringing cross-border remittance costs down by 2030 a reality today.

PRODUCTS AND SERVICES

Shop anywhere and choose Osnap at checkout to pay later. You'll pay for the first installment upfront, and the rest over 6 weeks. Split any purchase into 6 interest free installments over 6 weeks with Osnap, from OyaPAY.

Be it in-store or online, find a retailer with the Pay with Osnap from OyaPAY sign and add products to your baskets or cart. When done, scan the Osnap QR Code displayed. Osnap from OyaPAY only works with verified shoppers and retailers.

Split your purchase in 6, anywhere you shop. After you are presented with the total amount, enter the 1st split amount to make your first payment.

Shoppers and Retailers needs an active verified accounts to use Osnap from OyaPAY.

OyaCards from OyaPAY: Prepaid Virtual VISA/MasterCard Cards

Virtual prepaid VISA and MasterCard cards which you can use to pay for goods and services anonymously online and accepted worldwide.

Be it in-store or online, shop any day, anywhere with OyaCards from OyaPAY.

OyaCards enables users to convert wallet balance to virtual payment cards; Visa and MasterCard with limits such as how much a card can hold. The card can be terminated or funded anytime.

CURRENCIES SUPPORTED BY VIRTUAL CARD

BIF, CAD, CDF, CVE, EUR, GBP, GHS, GMD, GNF, KES, LRD, MWK, MZN, NGN, RWF, SLL, STD, TZS, UGX, USD, XAF, XOF, ZMK, ZMW, ZWD

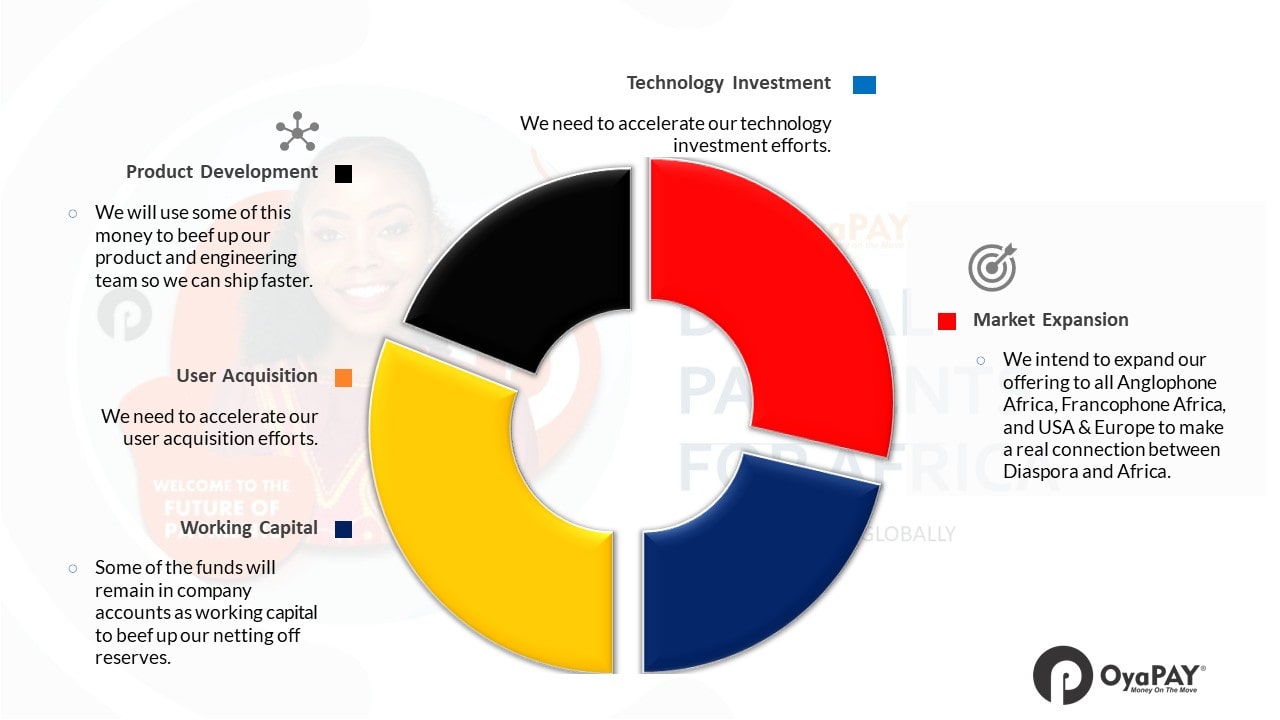

USE OF PROCEEDS:

- Product Development:

We will use some of this money to beef up our product and engineering team so we can ship faster.

- User Acquisition:

We need to accelerate our user acquisition efforts.

- Working Capital:

Some of the funds will remain in company accounts as working capital to beef up our netting off reserves.

- Technology Investment:

We need to accelerate our technology investment efforts.

- Market Expansion:

We intend to expand our offering to all Anglophone Africa, Francophone Africa, and USA & Europe to make a real connection between Diaspora and Africa.

How OyaPAY Makes Money:

OyaPAY generates revenue like any other option for Fintechs. We intend to charge the lowest tarrifs of the 3.9%+ been charged in Africa to use VISA and MasterCard today.

Competitive Advantage:

OyaPAY has three (3) main competitive advantages: proprietary software, efficient decentralized branches across Africa, and a digital-based service model.

All these factors combined provide what we believe is a competitive advantage for OyaPAY over both traditional AND next-gen competitors which we believe translates into more convenient, accessible, and affordable means of getting paid across Africa.

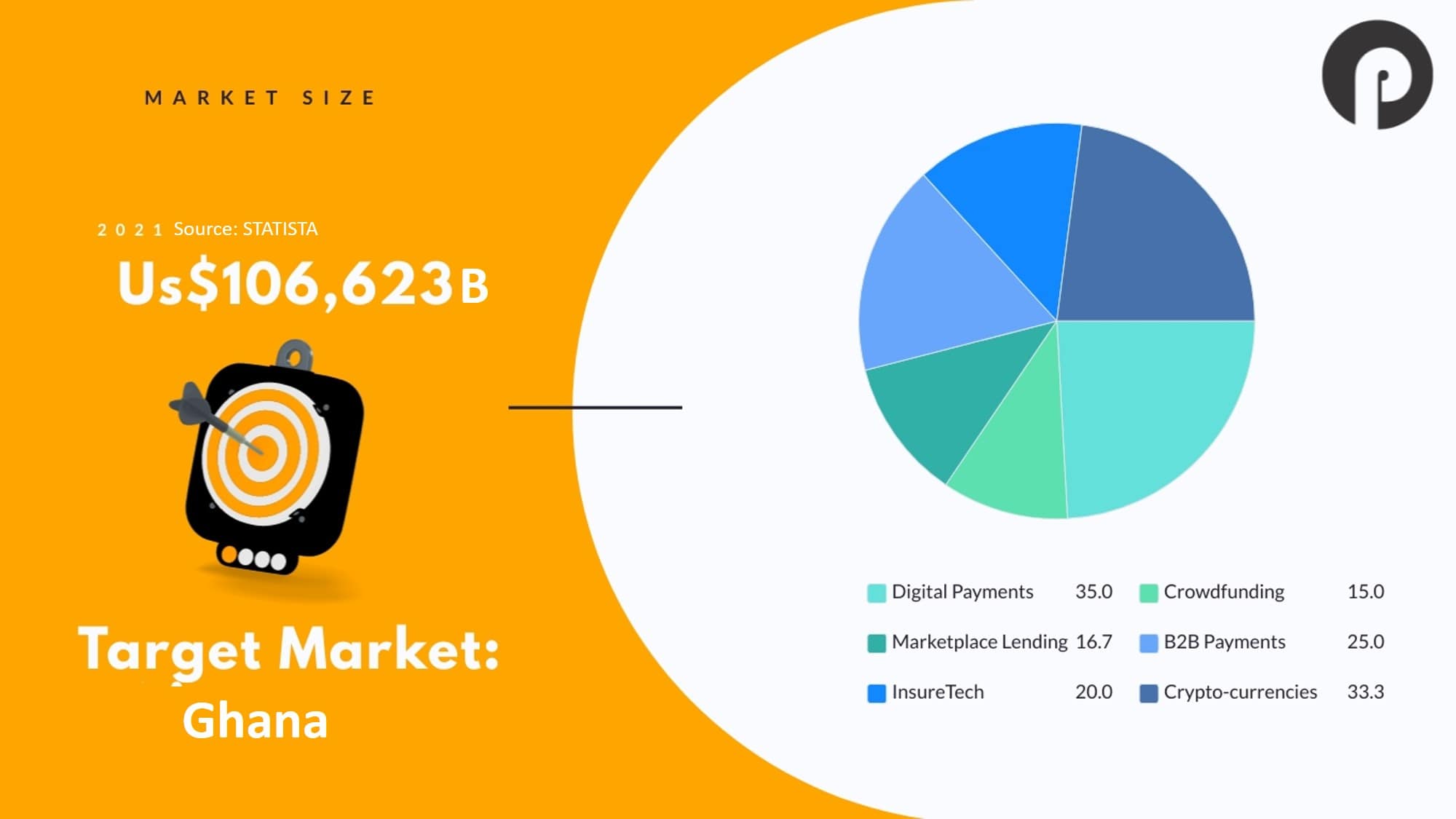

MARKET SIZE

TEAM STORY:

In early 2018, George Lamptey one day, left his office in Adabraka, with the aim of snapping a passport size photos for an urgent need and stroke across town to a photo studio where he found himself waiting in lines: finally, when it got his turn, the studio refused to accept the MTN Mobile Money he wanted to pay with, and rather requested for cash. He even offered to pay for the sending and receiving charges, yet they refused and asked him to go find an agent, withdraw and come pay with cash instead. George found himself thinking: in a new world of on-demand where you can order a car to pick you up within a few minutes, or have practically any retail product delivered to your doorstep, how can it be that the status quo for paying requires you to stand in lines, and often wait 10 - 20 minutes or more just to withdraw money from your digital wallet into cash, and pay for services?

George called for a meeting with his team when he got back to the office. The team was tasked to research on how best they can make digital payments popular for regular payments, even with hawkers on the street, and that was how JustPAY (former brand name of OyaPAY) was born.

The Team's findings after the research, was best suited to create and build an independent crossborder platform outside of the then Telcos managed payment services to avoid downturns whenever the telcos were facing service interruptions.

A year later, JustPAY was co-piloted in Ghana and Togo for cross-border transactions. Three years later, we have built the platform possible for all of Africa to pay and get paid with or without a bank account.

Now, we're expanding continental, targeting whole of West Africa, some selected East, Central, Southern and Northen African countries.

WHO'S BEHIND?

Gasby Group is a Pan-African leading technology organization offering Fintech, E-commerce, Business Intelligence Technology, Health Technology and Real Estate enabled solutions and services across Africa.

Our style is to lead with empathy and come together as a team to have a positive impact on the communities we serve. That’s why our values revolve around putting design first, setting the bar high, and doing what’s best for businesses and the continent.

We deliver HITECH transactional services, systems integration and managed services, ICT outsourcing services, strategic and technical consultancy, and a comprehensive range of enterprise-class managed cloud services coupled with an interest in general business solutions and services.

Join us build Africa's best tech solutions together. Make an impact and grow in your career or business at a startup with an inspiring mission.

OUR MISSION

Our mission is to create Africa's most innovative technology enabled services and products oriented ecosystem; a powerhouse to help drive developmental change across Africa.

OUR PROMISE

- Gasby Group is very much in-tune with the perculiar needs of the Ghana and African Startups and the SMEs sector. As the sector keeps changing, we keep ahead of our clients' needs by being innovative in the services we offer.

- We focus on making it convenient for SMEs and startups to access resourceful technologies as tools for their businesses using web, mobile, social media platforms and many more channels in reaching the most elusive of clients.

- With a plethora of skills and expertise, Gasby Group is the best and right choice to fulfil every SME and startup needs. Well qualified team to match and manage specific job/role requirements.

- Having served and worked with different brands with various needs, we have cultured the ability to discern distinct demands that we fulfil consistently.

We pride ourselves on hiring exceptional talent -- our team members come from a wide variety of top-tier African tech companies, professional services firms, and industry leaders.

To continue our rapid growth, we're looking to bring on people who are passionate about our mission and excited to work in a small startup environment. We have competitive salary and stock options and great benefits.

Term Sheet

General Risks and Disclosures

Start-up investing is risky. Investing in startups is very risky, highly speculative, and should not be made by anyone who cannot afford to lose their entire investment. Unlike an investment in a mature business where there is a track record of revenue and income, the success of a startup or early-stage venture often relies on the development of a new product or service that may or may not find a market. Before investing, you should carefully consider the specific risks and disclosures related to both this offering type and the company which can be found in this company profile and the documents in the data room below.

Your shares are not easily transferable. You should not plan on being able to readily transfer and/or resell your security. Currently there is no market or liquidity for these shares and the company does not have any plans to list these shares on an exchange or other secondary market. At some point the company may choose to do so, but until then you should plan to hold your investment for a significant period of time before a "liquidation event" occurs. A "liquidation event" is when the company either lists their shares on an exchange, is acquired, or goes bankrupt.

The Company may not pay dividends for the foreseeable future. Unless otherwise specified in the offering documents and subject to the country law, you are not entitled to receive any dividends on your interest in the Company. Accordingly, any potential investor who anticipates the need for current dividends or income from an investment should not purchase any of the securities offered on the Site.

Valuation and capitalization. Unlike listed companies that are valued publicly through market-driven stock prices, the valuation of private companies, especially startups, is difficult to assess and you may risk overpaying for your investment. In addition, there may be additional classes of equity with rights that are superior to the class of equity being sold.

You may only receive limited disclosure. While the company must disclose certain information, since the company is at an early-stage they may only be able to provide limited information about its business plan and operations because it does not have fully developed operations or a long history. The company may also only obligated to file information periodically regarding its business, including financial statements. A publicly listed company, in contrast, is required to file annual and quarterly reports and promptly disclose certain events through continuing disclosure that you can use to evaluate the status of your investment.

Investment in personnel. An early-stage investment is also an investment in the entrepreneur or management of the company. Being able to execute on the business plan is often an important factor in whether the business is viable and successful. You should be aware that a portion of your investment may fund the compensation of the company's employees, including its management. You should carefully review any disclosure regarding the company's use of proceeds.

Possibility of fraud. In light of the relative ease with which early-stage companies can raise funds, it may be the case that certain opportunities turn out to be money-losing fraudulent schemes. As with other investments, there is no guarantee that investments will be immune from fraud.

Lack of professional guidance. Many successful companies partially attribute their early success to the guidance of professional early-stage investors (e.g., angel investors and venture capital firms). These investors often negotiate for seats on the company's board of directors and play an important role through their resources, contacts and experience in assisting early-stage companies in executing on their business plans. An early-stage company may not have the benefit of such professional investors.