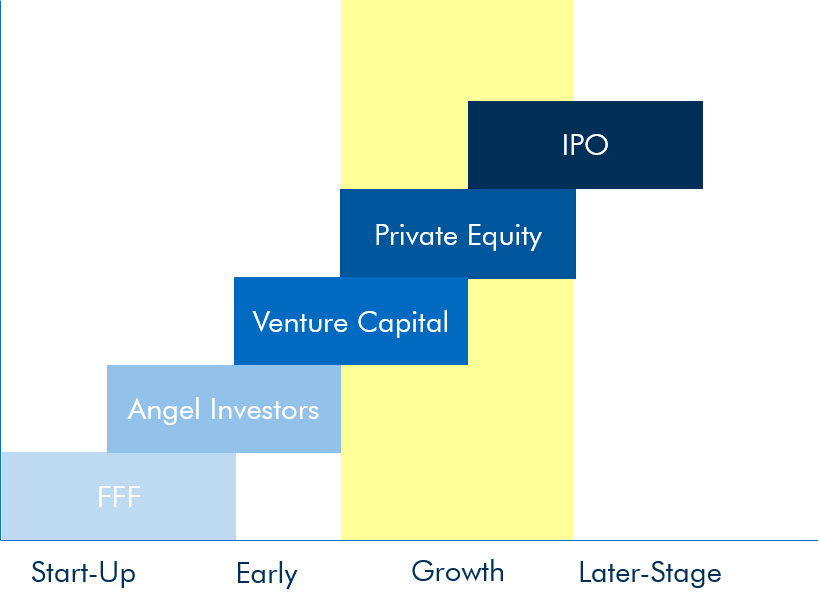

Types of Startup Funders

1. Angel investors

Angel investors are private individuals who usually finance startups during their early-stage period. They’re everyday people, usually family and friends, who invest in startups usually in exchange for equity or ownership in the company.

Now, the conventional definition of angel investors explains that angels are usually family members or friends but it’s not always so. Angels can be anyone interested in helping startups get their feet off the ground.

For example, Herconomy, a startup empowering women through financial literacy, raised $600,000 through the community crowdfunding route.

In Africa, several startup founders who have built successful startups are now venturing into becoming angels and helping other startups actualise their dreams. They include Olugbenga “GB” Agboola (Flutterwave), Odun Eweniyi (Piggyvest), and Shola Akinlade (Paystack).

2. Private Equity Investors

Private equity firms are coalitions of investors who invest in private companies i.e. companies that aren’t listed on the stock exchange.

These equity firms use a combination of both debt and equity financing to invest in high growth later-stage or mature companies that are often underperforming. These firms also acquire majority of the equity shares of the startups they invest in, in order to maximise output and growth. An example is Adenia Partners’ majority stake acquisition in Herholdt, a 57-year-old energy company in South Africa.

Presently, there are about 176 private equity firms in Africa that have made over 940 investments in the past decade alone. Examples are South Africa’s Norrsken22, Senegal’s WIC Capital and Egypt’s Sigma Capital Holding.

3. Venture Capital Firms

Now, Venture Capital firms or VC firms are a subset of Private Equity.

Unlike PE firms though, VCs invest in younger and smaller businesses. It’s also a coalition of investors who finance smaller businesses and startups with equity and/or debt financing. VCs also acquire lesser shares or minority stakes in the startups they invest in.

Most announcements we see are led by VC firms like Novastar Ventures, Oui Capital, Partech Ventures or Ingressive Capital. There are about 780 VC firms in Africa with over 78,000 investments across the years.

Credit: TechCabal

Arabic

Arabic French

French Chinese

Chinese